/

2013

Registration Document

/

Financial Report • 107

19 –

FINANCIAL STATEMENTS

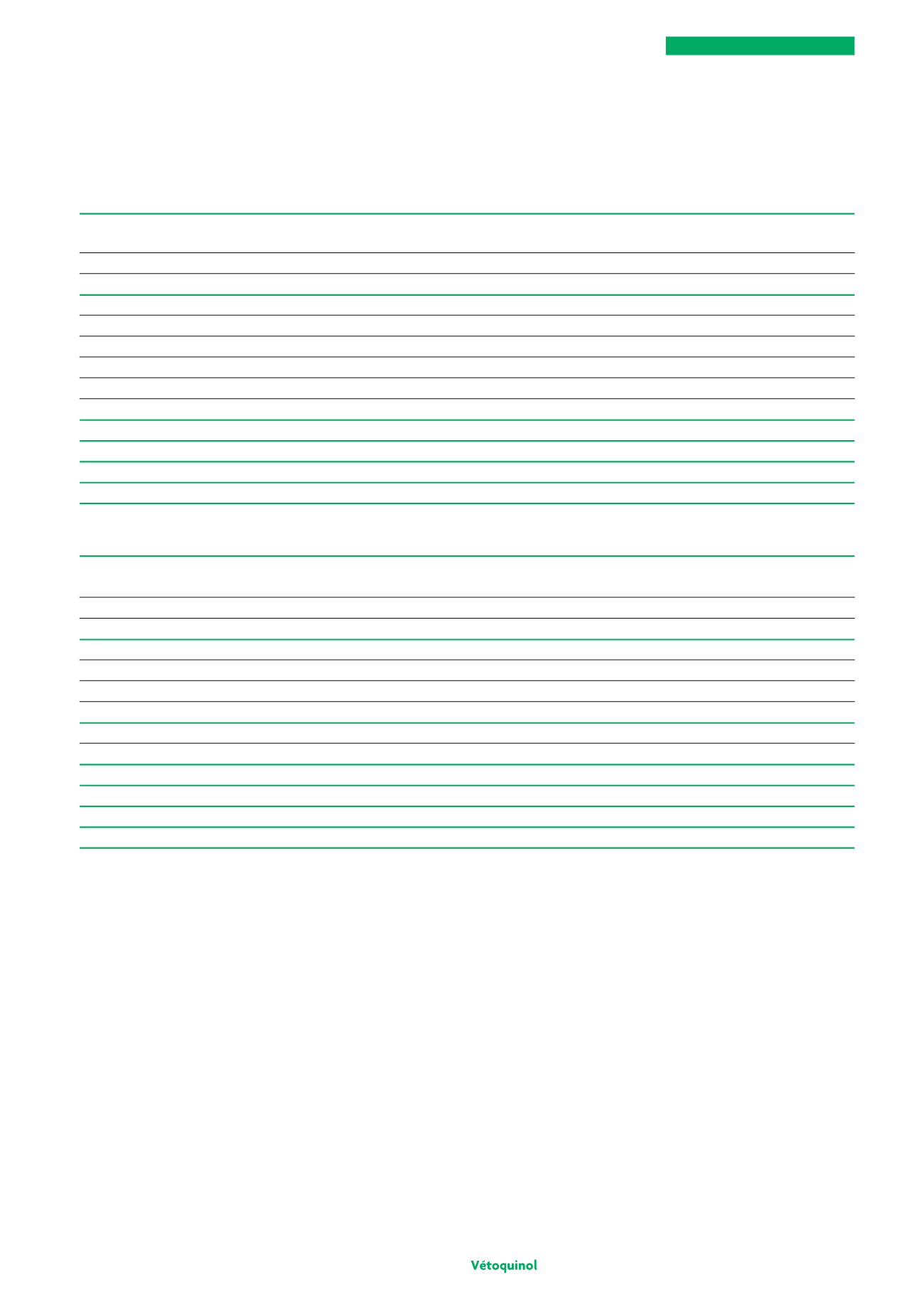

Analysis of the Group’s exposure to currency risk (IFRS 7) based on notional amounts is as follows:

€

000

Euros

CAD

CHF

USD

GBP

ZPN

Other

Total

currencies

Dec 31, 2013

Trade receivables

31,663

6,346

473

6,607

4,439

1,811

6,925

58,264

Impairment of trade receivables

(1,237)

(63)

(24)

(0)

(4)

(223)

(224)

(1,774)

Net trade receivables

30,426

6,283

450

6,606

4,436

1,589

6,701

56,490

Prepayments

432

720

0

513

0

103

79

1,846

Prepaid expenses

469

462

2

4

242

88

171

1,436

Receivables from government agencies

5,805

285

93

0

0

84

542

6,809

Other operating receivables

417

0

0

0

0

115

125

656

Miscellaneous receivables

436

11

11

17

3

201

35

714

Provisions

0

0

0

0

0

0

(10)

(10)

Total other receivables

7,559

1,478

105

533

245

590

942

11,452

Trade and other payables

45,011

7,651

638

3,192

2,946

3,040

3,571

66,048

Net trade and other payables

45,011

7,651

638

3,192

2,946

3,040

3,571

66,048

Total gross balance sheet exposure

(7,026)

110

(83)

3,947

1,735

(862)

4,072

1,893

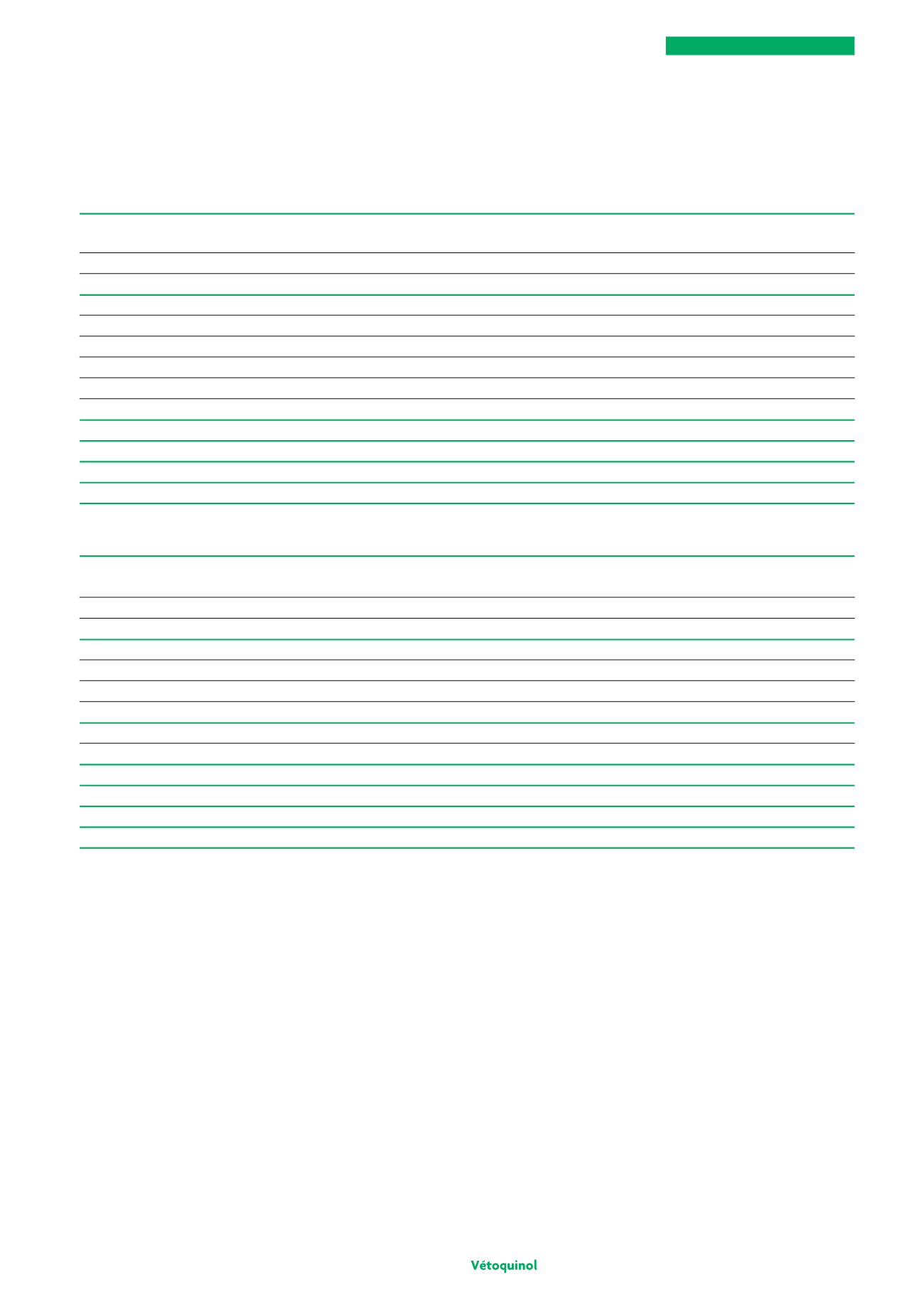

€

000

Euros

CAD

CHF

USD

GBP

ZPN

Autres

Total

monnaies

Dec 31, 2012

Trade receivables

26,584

5,871

426

6,515

4,179

2,309

5,882

51,766

Impairment of trade receivables

(1,244)

(64)

(22)

(47)

(3)

(183)

(207)

(1,771)

Net trade receivables

25,340

5,807

405

6,468

4,176

2,125

5,675

49,995

Prepayments

254

444

282

108

256

1,345

Prepaid expenses

583

338

8

25

210

134

151

1,450

Receivables from government agencies

5,341

461

281

567

6,649

Other operating receivables

153

3

171

10

95

432

Miscellaneous receivables

980

32

15

25

210

53

1,314

Provisions

0

0

0

0

0

0

(10)

(10)

Total other receivables

7,311

1,275

26

503

210

743

1,111

11,179

Trade and other payables

44,537

8,584

329

3,194

3,400

2,326

4,178

66,549

Net trade and other payables

44,537

8,584

329

3,194

3,400

2,326

4,178

66,549

Total gross balance sheet exposure

(11,886) (1,502)

101

3,776

985

542

2,608

(5,375)

19.1.4.2. Interest rate risk management

The Group’s general policy on interest rate risk is to globally

manage its exposure through the use of swaps and options.

Pursuant to the provisions of IAS 39, whenever the conditions

for hedge accounting are met, the Group applies the relevant

procedures. When these conditions are not met, or if the

amounts concerned are not material, as has been the case in

recent years, derivatives are carried on the balance sheet at their

fair value, and all changes in fair value are posted to income, in

accordance with the provisions of IAS 39.

Normally, the Group’s exposure to interest rate risk is insignificant

and concerns basically two line items on the balance sheet:

financial liabilities and cash.

As of December 31, 2013, 59% of the Group’s financial liabilities

(including bank overdraft facilities) bore interest at a fixed rate,

compared to 32% as of December 31, 2012. Floating rate

commitments amounted to

€

15.1 million as of December 31,

2013, compared to

€

34.2 million as of December 31, 2012.

The latest

€

16 million loan taken out by the Group to finance

the Orsco acquisition was swapped in 2013.

The Group’s investments consist of fixed-rate term deposits

with major banks, whilst the corresponding bank overdrafts are

subject to a floating rate. This enabled the Group to minimize its

interest costs for the 2013 financial year.

On the basis of the 2013 financial statements, an increase of

100 basis points in interest rates would have increased earnings

by

€

328,000, whereas in the previous year it would have

decreased earnings by

€

180,000.