4

34

Vetoquinol

J

2016

Registration Document

J

Annual Financial Report

CONSOLIDATED FINANCIAL STATEMENTS

AFR

Notes to the consolidated financial statements

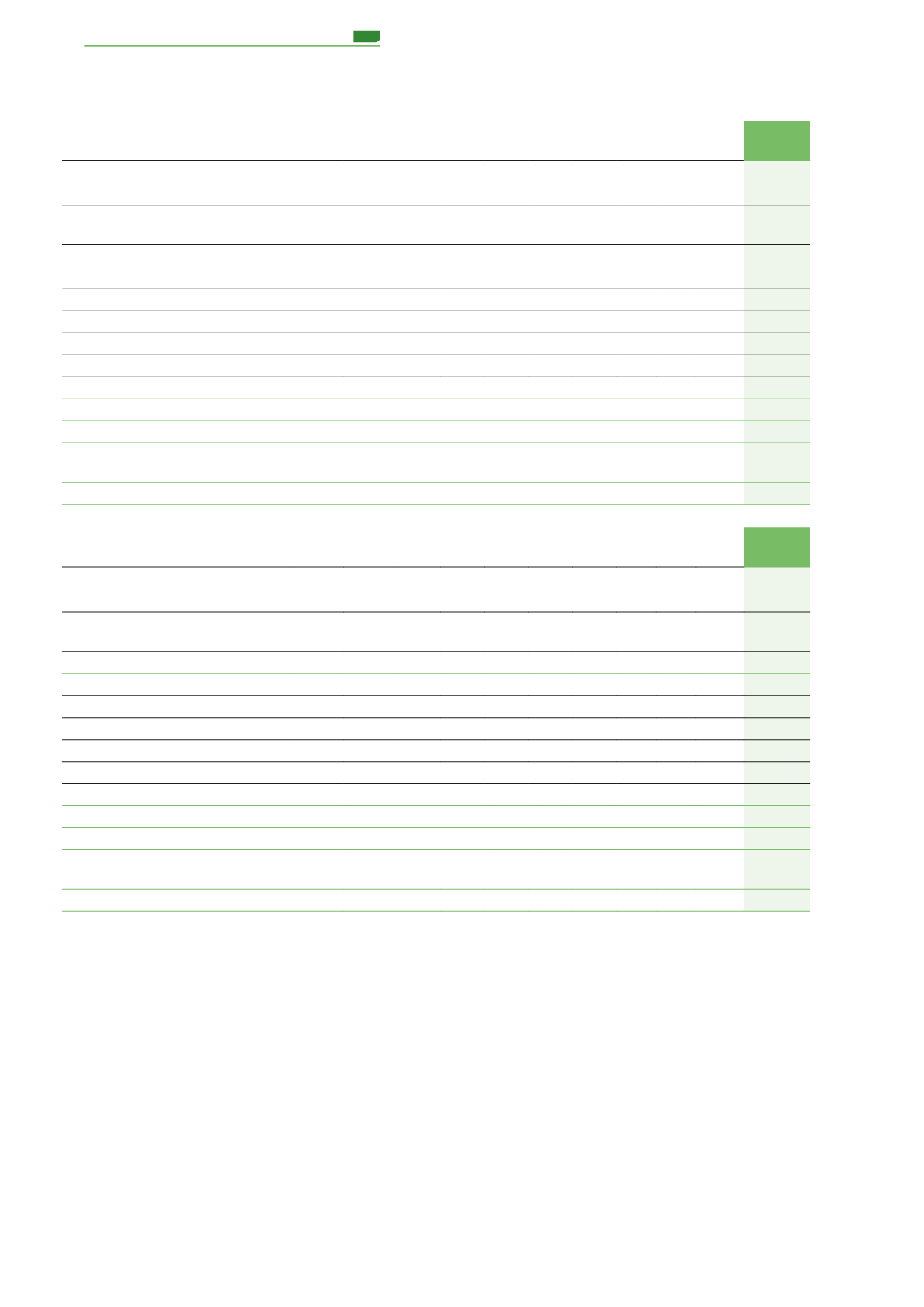

Analysis of the Group’s exposure to currency risk (IFRS 7) based on notional amounts is as follows:

€000

EUR USD CAD GBP INR PLN BRL AUD CHF Other

Total

currencies

Dec 31, 2016

Trade receivables

31,557 10,654 5,883 6,130 4,444 1,399 2,177 598 510 3,222

66,574

Impairment of trade receivables

(1,291)

(34)

(2)

(13)

(343)

(399)

(30)

(182)

(48)

(66)

(2,408)

Net trade receivables

30,266 10,619 5,881 6,117 4,101 1,000 2,147 417 462 3,156 64,166

Prepayments

246 474

36

-

22

6 55 18

-

20

877

Prepaid expenses

352

16 1,051 101 69 143

5 1 7 193

1,938

Receivables from government agencies 5,938

-

-

-

86 85 882 24

- 716

7,733

Other operating receivables

322 57 17

-

-

21 103 -

-

-

522

Miscellaneous receivables

685

-

12

-

75 151

6

- 101

5

1,035

Provisions

-

-

-

-

-

-

-

-

-

-

-

Total other receivables

7,543 547 1,116 101 253 408 1,052 43 108 934 12,105

Trade and other payables

43,543 7,643 9,291 3,755 2,947 2,268 1,130 454 343 1,422

72,797

Net trade and

other payables

43,543

7,643

9,291

3,755

2,947

2,268

1,130

454

343

1,422

72,797

Total gross balance sheet exposure (5,734) 3,524 (2,294) 2,463 1,406 (860) 2,068 6 227 2,668

3,473

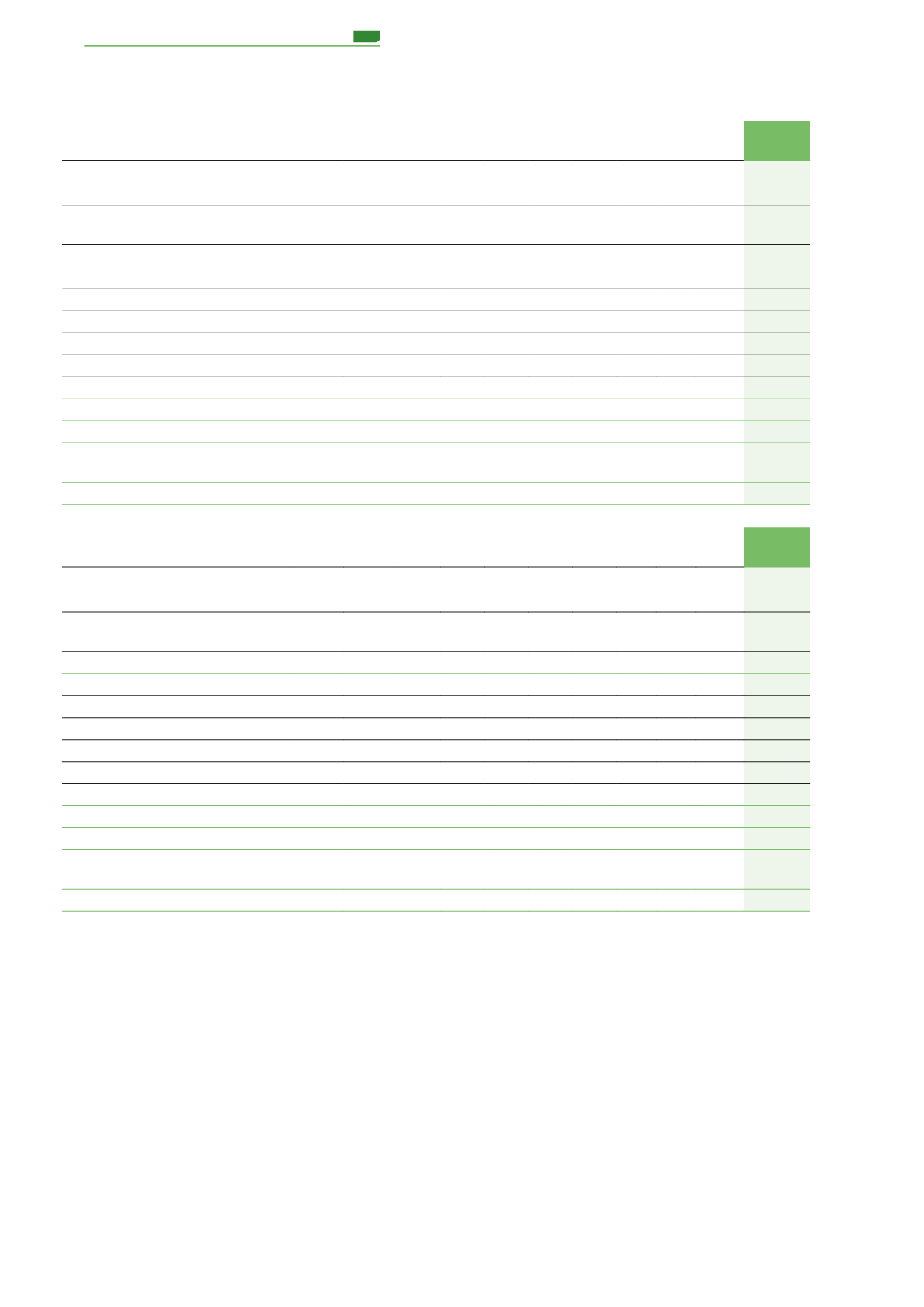

€000

EUR USD CAD GBP INR PLN BRL AUD CHF Other

Total

currencies

Dec 31, 2015

Trade receivables

30,818 8,179 5,978 5,634 2,854 1,739 1,764 480 542 2,911

60,900

Impairment of trade receivables

(1,349)

(3)

(19)

(1)

(179)

(357)

(44)

-

(29)

(29)

(2,010)

Net trade receivables

29,469 8,176 5,958 5,633 2,675 1,382 1,720 480 514 2,882 58,890

Prepayments

251 160 167

-

20 12 46 36

-

16

708

Prepaid expenses

383

10 463 204 67 113

1 1 6 144

1,394

Receivables from government agencies 4,322

- 223

-

76 42 665 17 45

92

5,483

Other operating receivables

299 527

6

-

-

24 79 -

-

1

935

Miscellaneous receivables

472

21

16

-

74 191

5 9 71

2

861

Provisions

-

-

-

-

-

-

-

-

-

-

-

Total other receivables

5,728 718 875 204 237 383 797 64 121 255

9,381

Trade and other payables

40,087 7,127 10,078 3,698 2,230 2,442 801 980 352 824

68,619

Net trade and

other payables

40,087

7,127

10,078

3,698

2,230

2,442

801

980

352

824

68,619

Total gross balance sheet exposure (4,891) 1,767 (3,244) 2,139 682 (678) 1,715 (435) 284 2,313

(348)

4.5.4.2 Interest rate risk management

The Group’s general policy on interest rate risk is to glob-

ally manage its exposure through swaps. Pursuant to the

provisions of IAS 39, whenever the conditions for hedge

accounting are met, the Group applies the relevant proce-

dures. When these conditions are not met, or if the amounts

concerned are not material, as has been the case in recent

years, derivatives are carried on the balance sheet at their

fair value, and all changes in fair value are posted to income,

in accordance with the provisions of IAS 39.

Normally, the Group’s exposure to interest rate risk is

insignificant and concerns basically two line items on the

balance sheet: financial liabilities and cash.

As of December 31, 2016, 99.7% of the Group's financial

liabilities (including bank overdrafts) bore interest at a fixed

rate (2015: 99.6%). Floating rate commitments amounted to

€0.1 million as of December 31, 2016 (2015: €0.1 million).

The latest €41 million loan taken out by the Group to finance

the Bioniche acquisition was swapped in 2014, as was the

2013 €16 million loan for the Orsco acquisition.

The Group's investments consist of fixed-rate term depos-

its with major banks, whilst the corresponding bank

overdrafts are subject to a floating rate. This enabled the

Group to minimize interest costs during 2015 and 2016.

On the basis of the 2016 financial statements, a 100 basis

point increase in interest rates would have increased earn-

ings by €676,000 (2015: €447,000 increase in earnings).