Sales: €256m (-5.4% as reported)

Essentials products sales: €151m (59% of Group sales)

Net income - Group share: €32m (12.6% of sales)

EBITDA*: €54m (20.9% of sales)

Cash-flow generation: €31m

Matthieu Frechin, Chairman and CEO of the Vetoquinol laboratory, commented: "In a global animal health market driven by prices, our first half of 2023 is marked on the one hand by a decline in our business and on the other hand by the continuation of a sound level of profitability and good cash generation. The agility and mobilization of our teams and the evolution of our product mix over the last 10 years, at a time when our Vetoquinol laboratory is celebrating its 90th anniversary, enable us to anticipate a better 2nd half of 2023. The solidity of our business model reinforces our determination to pursue hybrid, sustainable and profitable growth."

The Board of Directors of Vetoquinol SA met on September 6, 2023 to review business activity and approve the financial statements for the first half of 2023. The auditors have released their first half limited review report

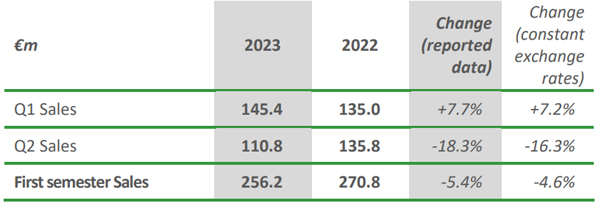

Vetoquinol reported sales of €256 million for the first 6 months of FY 2023, down -5.4% on a reported basis and -4.6% at constant exchange rates. For the 1 st half of FY 2023, Vetoquinol recorded a negative currency impact of -€2 million, mainly related to the Asia/Pacific region. The overstocking effect recorded in the 1st quarter 2023 of around €10 million, to ensure continuity of service while a new ERP system is put in place, is fully smoothed out by the end of June 2023.

Sales of Essential products totaled €151 million, down slightly by -1.1% at constant exchange rates. They benefited from the existing portfolio and the recent launches of Felpreva®, an antiparasitic solution for cats, and Simplera®, a drug indicated for the treatment of otitis in dogs, and were impacted by the downturn in the livestock antibiotics segment. Sales of Essentials products accounted for 59% of the laboratory's sales in the first half of 2023, compared with 57% of sales in the first half of 2022.

At June 30, 2023, the Americas territory grew by +2.3% at constant exchange rates, driven by growth in the US market and the recent launch of Simplera®. The Europe and Asia/Pacific/Rest of World territories were down by -5.4% and -16.3% respectively at constant exchange rates. Sales in Europe were notably impacted by a downturn in the livestock antibiotics market. On the other hand, Vetoquinol benefited from the launch of Felpreva® and continued to strengthen its position in the pet market with this drug, which combines ease of use with a 3-month duration of effect.

Sales of companion animals products (€181 million) were stable on a like-forlike basis (-0.4%), and accounted for 70.7% of the laboratory's total sales. Sales of farm animal products came to €75 million, down 13.3% on a like-for-like basis.

Gross margin on purchases was 72.1%, identical to that for the H1 2022 and up 1.5 point on the FY 2022 figure (70.6%). This trend is linked to the product mix, and in particular to new Essentials launches, as well as to higher selling prices.

Other purchases and external charges fell by -7.9% (-€4.2 million), mainly as a result of tight cost control in a period of inflation. Personnel costs rose by +2.9% in line with salary increases.

Depreciation and amortization charges linked to IFRS 16 generated a depreciation charge of €2.9 million, compared with €2.7 million at end June 2022.

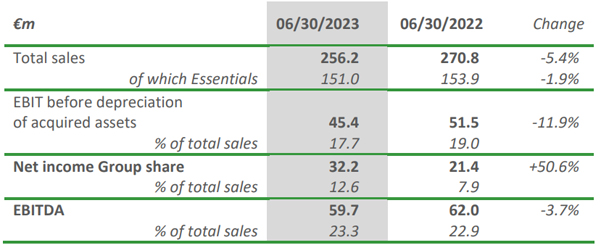

EBIT before amortization of intangible assets acquired amounted to €45 million for the year ended June 30, 2023. This represents 17.7% of consolidated sales.

Group operating income recurring came to €39 million (15.1% of sales), compared with €44 million for the first 6 months of 2022.

Other operating income and expenses amounted to €2.6 million, compared with -€9.3 million at end June 2022. They reflect the outcome of the renegotiation of the final acquisition price of Clarion in Brazil, with a gain of +€6.1 million, and a still uncertain situation in this country generating an impairment of intangible assets for €3.5 million. In the first half of 2022, Vetoquinol recorded a non-recurring impairment charge of -€9.3 million on its Brazilian goodwill.

The apparent tax rate was 24.4% (vs. 38.0% at end June 2022). Restated for the impairment of Brazilian goodwill, the apparent tax rate for the 1st half 2022 was 30.0%.

EBITDA stood at €60 million at June 30, 2023, or 23.3% of sales. Restated for non-recurring items in Brazil, EBITDA for the first half of 2023 came to €54 million, or 20.9% of sales.

Net income for the Vetoquinol laboratory came to €32 million, or 12.6% of H1 2023 sales, up +50.6% on net income at end-June 2022.

At June 30, 2023, the Vetoquinol Group had an overall positive net cash position of €84 million (after taking into account an IFRS 16 liability of €13 million), up +€7 million vs. end-2022. The laboratory benefited from solid free cash flow generation compared with H1 2022.

The successful structural transformations with the deployment of a new ERP in the laboratory's main subsidiaries and the modernization of the sterile injectables production unit located in Lure enable Vetoquinol to approach future developments with confidence.

The Vetoquinol Group has sound fundamentals (strong operating profitability, cash flow generation, no debt) to pursue its development strategy, and the means to finance its external growth ambitions.

The replay of the video conference and the presentation of the 2023 Half-Year Results are available on the laboratory's website: https://vetoquinol.com/en/investors

Next update: Q3 2023 Sales, October 26, 2023 after market close

ANNEX

SALES

SUMMARY INCOME STATEMENT

CALCULATION OF EBITDA

ALTERNATIVE PERFORMANCE INDICATORS

Vetoquinol Group management considers that these indicators, which are not defined by IFRS, provide additional information that is relevant for shareholders seeking to analyze underlying trends and Group performance and financial position. They are used by management for performance analysis.

Essentials products: The products referred to as “Essentials” comprise veterinary drugs and non-medical products sold by the Vetoquinol Group. They are existing or potential market-leading products designed to meet the daily requirements of vets in the companion animal or livestock sector. They are intended for sale worldwide and their scale effect improves their economic performance.

Constant exchange rates: Application of the previous period’s exchange rates to the current financial year, all other things remaining equal.

Like-for-like (LFL) growth: Year-on-year sales growth in terms of volume and/or price at constant consolidation scope and exchange rates.

EBIT before amortization of acquired assets: This KPI isolates the non-cash impact of depreciation charges on intangible assets arising from mergers and acquisitions.

Net cash: Cash and cash equivalents less bank overdrafts and borrowings, (IFRS 16 compliant)

Latest news

March 2024

January 2023