Matthieu Frechin, CEO of Vetoquinol, said: "Business at the end of September 2022 is in line with our business forecasts for the end of the year. 2022 is proving to be a rather atypical year. The market is landing after the strong activity during the two Covid years and is suffering from the current unprecedented geopolitical and economic environment. In this context, Vetoquinol remains strong and solid".

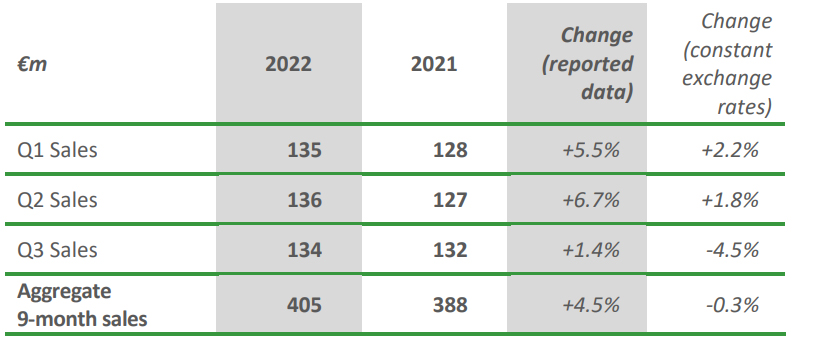

Sales for the first nine months of 2022 amounted to €405m, up 4.4% on the same period last year and stable (-0.3%) at constant exchange rates; this is in line with the expected outlook for the end of the year.

As expected, third-quarter sales came to €134m (up 1.4% on a reported basis and down 4.5% at constant exchange rates). It reflects the expected landing of the post-Covid market and the negative effects of the geopolitical context, particularly in Europe and in farm animals. On a reported basis, Europe declined by 8% in the third quarter; the Americas and Asia/Pacific each grew by 10%.

Over the first nine months of the year, Essentials grew by 6.3% (3.1% at constant exchange rates) and companion animals by 9.5% (4.9% at constant exchange rates). The Americas, driven by the performance of the United States, grew by 11.9% (+0.2% at constant exchange rates), and Asia rose by 9.6% (+5.5% at constant exchange rates). Europe declined slightly by 2.0% (-2.4% at constant exchange rates).

Launches in progress

Since the beginning of the year, the laboratory has launched several Essential products: Felpreva®, Imoxi® and Phovia®. The contribution of these global brands to the Group turnover will accelerate as they ramp up.

Vetoquinol's financial structure at 30 September 2022 is solid. The revenue at the end September 2022 has not been audited.

Next update: Annual Sales 2022, January 18th, 2022 after market close

ANNEX

ALTERNATIVE PERFORMANCE INDICATORS

Vetoquinol Group management considers that these indicators, which are not defined by IFRS, provide additional information that is relevant for shareholders seeking to analyze underlying trends and Group performance and financial position. They are used by management for performance analysis.

Essentials products: The products referred to as “Essentials” comprise veterinary drugs and non-medical products sold by the Vetoquinol Group. They are existing or potential market-leading products designed to meet the daily requirements of vets in the companion animal or livestock sector. They are intended for sale worldwide and their scale effect improves their economic performance.

Constant exchange rates: Application of the previous period’s exchange rates to the current financial year, all other things remaining equal.

Like-for-like (LFL) growth: Year-on-year sales growth in terms of volume and/or price at constant consolidation scope and exchange rates.

Latest news

March 2024

January 2023